- #TURBOTAX LOGIN CUSTOMER SERVICE PHONE NUMBER VERIFICATION#

- #TURBOTAX LOGIN CUSTOMER SERVICE PHONE NUMBER FREE#

Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2022 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited individual returns filed with TurboTax for the current 2022 tax year and, for individual, non-business returns, for the past two tax years (2021, 2020).

#TURBOTAX LOGIN CUSTOMER SERVICE PHONE NUMBER FREE#

(TurboTax Online Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax.

#TURBOTAX LOGIN CUSTOMER SERVICE PHONE NUMBER VERIFICATION#

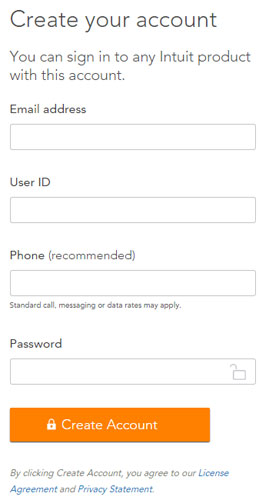

If you can't confirm your identity using the IRS' online Identity Verification Service, you can call the IRS at the phone number included in the letter. If you receive such calls or emails, they are likely a scam. The IRS will not request that you verify your identity by contacting you by phone or through email. This online service is the quickest method and will ask you multiple-choice questions to verify whether or not the tax return flagged for further identity verification was filed by you or someone else. It will include a couple ways to verify it: via a phone number or through the IRS's Identity Verification Service. When the IRS stops a suspicious tax return filing, they may send a letter called " Letter 5071C" asking that you verify your identity.

Request for Identity Verification from the IRS

The IRS will not initiate contact with you by phone or via email. TurboTax Tip: The IRS only notifies taxpayers of issues by mail. If you did not receive an IRS notice, mail your documents to: Mail the form and documents to the address shown in your notice. If you received an IRS notice concerning the fraudulent return, include a copy of the notice. Passport, military ID or other government-issued identification card. If you don’t have a driver’s license, you can substitute a U.S. Even if you don’t get a letter from the IRS but suspect a fraudulent return has been filed with your information, you can still take action.Īfter you complete Form 14039, mail it to the IRS with a copy of your Social Security card and driver’s license. When the IRS receives two different returns with the same Social Security number, the second return filed will be rejected if you e-filed or if you paper-filed you’ll get a written notice that explains that a return has already been filed. The second return could be from you or the person who has stolen your information. In many cases, when someone files a tax return using your Social Security number, you won’t find out until after the second return is filed. You can respond via telephone or through the IRS' online Identity Verification Service.

0 kommentar(er)

0 kommentar(er)